The BRICS, Gold, and the Dollar's Future

Exploring the possibility of a dramatic shift in the global monetary system

While this article will delve into some complex topics regarding the global monetary system, reserve currencies, and central banking, I think it’s important for everyone and every American especially to know about these developments, since they may significantly affect the future of the United States’ economic power and world status. Since I know many of my readers are laymen, I will try to simplify these concepts as much as possible, and sincerely hope I succeed.

As the 2008 recession began, something surprising happened: even though the recession’s origin was the United States, and our banks caused it with their risky mortgage backed security transactions, capital actually flowed into the US at a rapid rate as the news broke. As happens when capital flows into a country, our currency appreciated, and interest rates fell as demand for Treasuries spiked. Our “safe haven” status meant that for the next twelve years, whenever there was global economic risk, capital flowed into the US. Europe had its sovereign debt crisis in the early 2010s, Japan was plagued by issues, and despite its massive economic growth, China remained untrustworthy due to its (nominally) Communist government and currency manipulations. The US was the only game in town.

How did we get here?

Then came the pandemic, and three things occurred:

The US began to run an even more enormous budget deficit, and as inflation rose, interest rates had to be hiked to keep up with it. (Few will buy a bond whose yield is lower than the inflation rate.) As interest rates rose, borrowing costs became unsustainable, and the US entered a not-widely-reported but serious debt crisis, with interest payments approaching 40% of federal government revenue.

The BRICS alliance strengthened significantly. It was already significant when it included Brazil, Russia, India, China, and South Africa, the original countries in the acronym. But in 2024, Egypt, Ethiopia, Iran, the UAE, and Indonesia signed on, with nine more countries signing on as partner states. The BRICS now encompasses 30% of the world’s GDP.

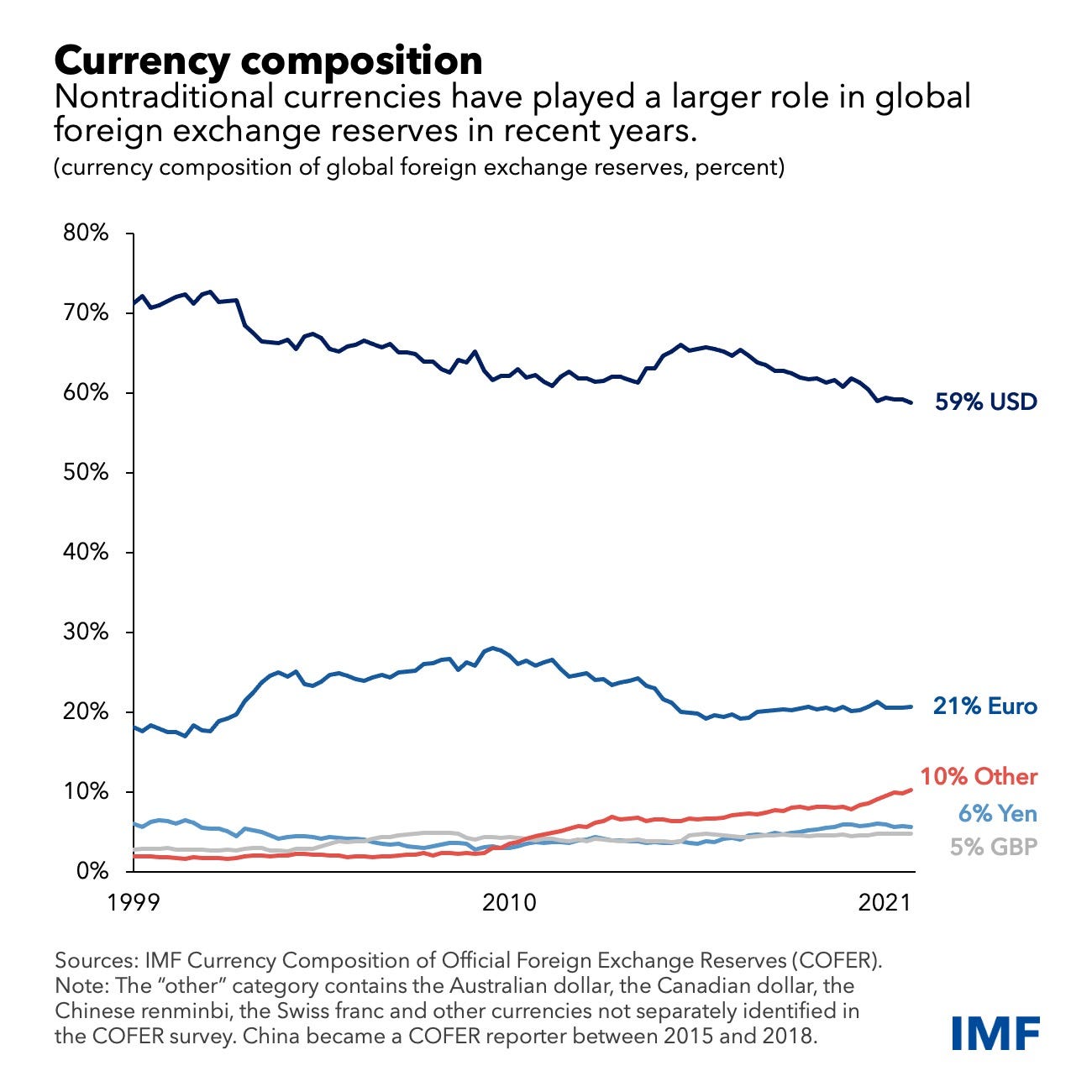

The alliance became more ambitious, discussing issuing a gold-backed currency to replace the dollar as the world’s reserve. The world’s reserve just means that when large international transactions are made, they are settled in dollars, which is beneficial for the US as our banks handle the deals and funds. But they aren’t beneficial for other countries, which have to trade into dollars out of their own currencies. So they want to issue a joint currency. None of them are particularly creditworthy on their own, so they decided to back the new currency with gold, in other words, allow people to redeem the currency they hold for gold bars at a fixed rate. As a result, central banks, particularly China’s, have been aggressively buying gold in order to have enough to create the currency.

What does this all mean?

It might go nowhere. While the BRICS countries, especially Russia, appear to be quite serious about their plan, there is always a possibility that it does not succeed. A lot of agreement will be required among BRICS’ member countries, and despite the gold backing, the new currency may not be adopted by a wider group of countries even if it does happen. So making any plans based on the currency’s existence is not something we would recommend.

It could have further interesting impacts on the gold price. Gold has been a great investment since the mid-2000s, and since BRICS began accumulating gold, the price has risen at an even more rapid rate. But having a floor of central bank demand underneath it could skyrocket it even higher. Contrarily, if the new currency idea fails, central banks could sell all their gold, causing a swift drop in prices.

It could force the US to get our house in order. Facing competition that it hasn’t since before World War II, the US could balance its budget in order to have a more competitive currency, or even go back to gold convertibility as we did before President Nixon made the shift to fiat in 1971.

In the long term, it could be bad for the US. The US is already on a collision course with the rest of the world due to tariffs. And President Trump has threatened an 100% tariff against any country participating in a new currency. This is a dangerous game. But it’s understandable why Trump is making these threats, because the success of this project could be bad for the United States. Being the world’s reserve currency has a number of advantages for us, including more business for our banks, negotiating power with other countries, and most importantly, lower interest rates due to widespread foreign investment. The end of this paradigm could signal sharply higher borrowing costs that more accurately reflect our deteriorating financial position.

It could lead to a different world foreign policy wise. Countries might be more afraid of the US’s financial power than its military power. We have the ability to cut countries off from the international financial system due to our control of those institutions, as we recently did with Russia. A currency backed by BRICS might not have those impacts, and might cause the United States to lose significant foreign policy leverage.